Who's The King Of The NZ Retirement Home Sector?

Ryman, Summerset, Arvida, Oceania all compete directly, but is there a standout?

All the major retirement home companies in NZ follow the same model.

The gist:

They sell you a home in their village.

You live in the home for as long as you’re alive.

When you “vacate” the property (i.e. when you die) the company buys the home back from you, minus a “management fee” - usually about 25%.

They sell the home to a new retiree, and so on and so on.

There’s a catch. Technically you don’t own the home after you buy it.

You’re actually buying an “occupational right agreement” also known as an ORA, which is about the price of a small house.

This gives you the right to live in the property for as long as you’re alive, and the village agrees to buy the ORA back from you after you vacate (i.e. when you die).

Here’s the typical flow of events:

You’ve reached retirement age and since your kids are gone, the family home is too big/expensive/tiring to keep and maintain yourself.

You sell it.

You use that money to buy an ORA in a retirement village for $500k.

You live a nice cushy life where the lawns are mowed for you and there’s a restaurant on site and everything is safe and organised and there’s a fountain outside your window.

When you die, the company buys the ORA back off you for the same price you paid for it ($500k), minus a 20% fee.

$400k goes to your estate for your grandkids, and $100k goes to the village.

They sell the ORA to someone else, and so on.

The key selling points are:

It’s usually cheaper than a regular house.

It has all healthcare, amenities, movie theatres, restaurants, security, events etc on site.

The village provides a community.

No housework (gardening, lawns, maintenance etc is all taken care of)

No fuss dealing with real estate - you buy the unit at a fixed price, then when you die, the company buys it straight back off you, which makes things very fast and convenient.

And of course, all this convenience costs you some money, which is how these retirement home operators make a profit.

Care Units versus Retirement Units

These companies usually have three sources of revenue:

Management fees

Care fees

Gains in property values

Management fees

These come from the village units.

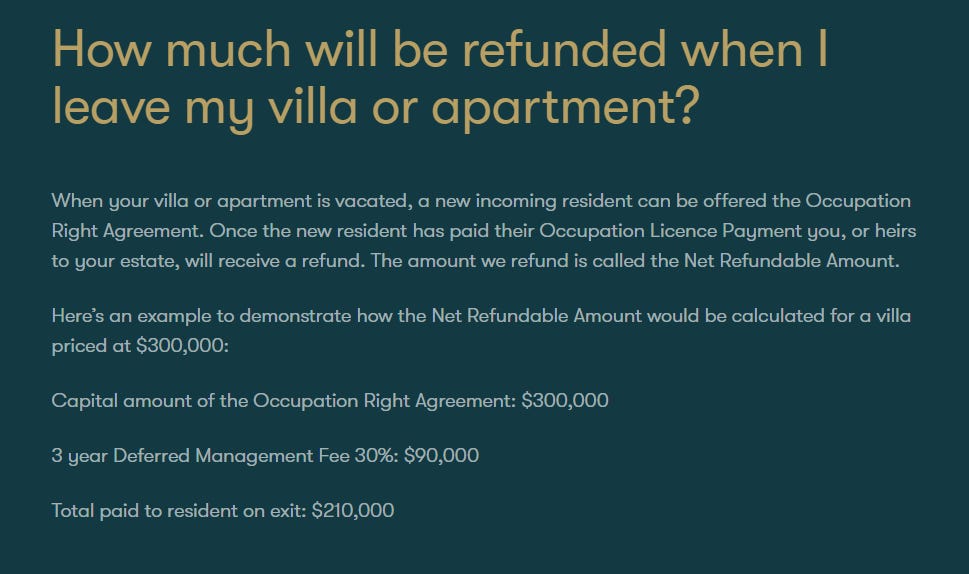

You buy an ORA for $400,000, when you die, the company buys the ORA back off you for $400,000, but takes a $100,000 fee.

These are known as “deferred management fees” and is a big chunk of how these companies make money.

The deferred management fee ranges between 20% to 30% for the major operators.

They also make money via capital gain on these units as house prices inevitably increase over time (after they buy it back off you for $400,000, they sell it to the next person for $500,000 etc).

Here’s an example from Oceania Healthcare:

Care fees

These come from care units or care beds.

This is more akin to what you might know as a nursing home.

In this situation, a person who needs constant medical attention (think people with alzheimers, dementia) moves into a care unit and is provided medical care 24/7, with nurses and doctors on hand.

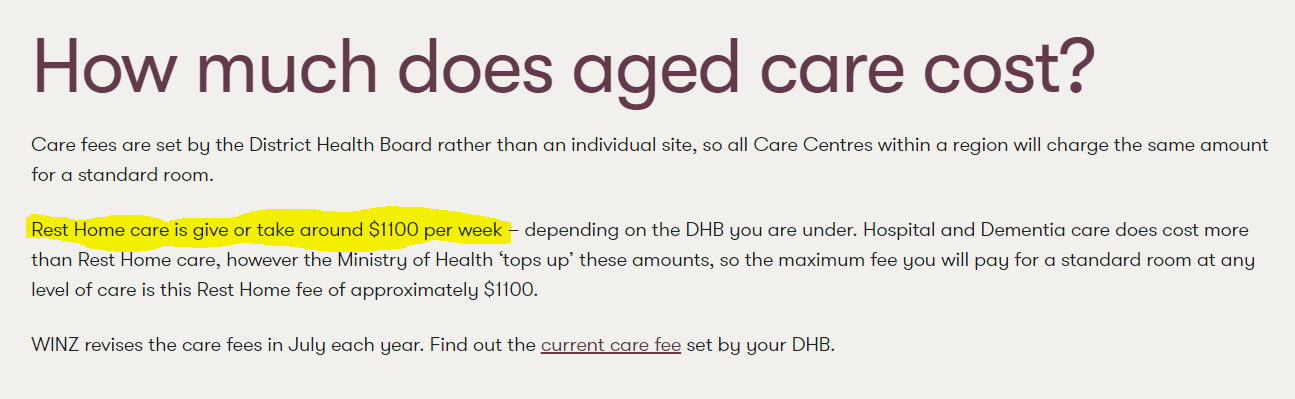

One thing to keep in mind about aged care is it’s actually paid for by your DHB, not the patient itself, meaning it’s a pretty stable revenue stream. However, it also means the government sets the rate, so the villages have limited pricing power.

Some retirement villages might also offer “upgraded” aged care, for an additional price of course.

Here’s an example from Oceania Healthcare:

Most retirement villages offer both options - village units for those who are still healthy enough to live independently, and care units for those who need round-the-clock care.

Along with deferred management fees and care fees, they also receive weekly management fees to pay for the day-to-day costs of the village, kind of like a weekly body-corp.

The base rate is usually $100-$200 per week, depending on how bougie your village is.

So in summary, they make money in the following ways:

Deferred management fees

Care fees from the DHB

Additional care fees from “premium” care services

Weekly management fees

Additional management fees from “premium” living services

Gains in property values

Who are the key players?

There are currently four major retirement home operators on the NZX:

Ryman Healthcare

Summerset Group

Arvida Group

Oceania Healthcare

There is also Radius Healthcare which is a new listing, but it’s very small and after a quick look I’ve decided it’s not worth looking into further at this stage.

Let’s do a few comparisons (note these numbers weren’t 100% clear from the annual reports, so might not be 100% accurate):

Ryman is clearly the biggest, with the most village units and the most care beds.

Summerset and Arvida are of similar size, both skewed more towards village units, though Arvida is more evenly spread between them.

Oceania is the smallest and is more heavily focused on care.

One thing to note is Oceania and Arvida have a lot of villages being developed, but many of these are “brownfield” developments, meaning there are already existing retirement facilities on the land (as opposed to “greenfield” developments which are from scratch).

The advantage of brownfield is you make money faster, as the facilities are already built.

The advantage of greenfield is the quality is better (since brand new builds), plus you have full control over design/consistency/branding.

All of this is interesting, but what really matters is numbers.

Who’s making the most money?

Again, Ryman is the biggest so naturally brings in the most money in both management fees and care fees, has the most assets, and makes the most profit.

Summerset makes the second most in managements fees, and the lowest in care fees.

Oceania makes the second most in care fees, and once again Arvida is somewhere in between.

In terms of assets, Summerset is significantly larger than both Oceania and Arvida.

However, this picture is not so clear.

The financial accounts don’t tell the full story

There’s some tricky accounting in this section so I might lose some of you in the next few paragraphs, but try and stay with me.

Normally, my starting point for analysing any company is the Cashflow Statement.

The Cashflow Statement essentially shows what came into the bank account, and what went out of the bank account.

There’s not a lot of room for tricky accounting with cashflow.

People use tricky accounting to bullshit the Income Statement and bullshit the Balance Sheet, but it’s hard to bullshit the Cashflow Statement.

However, in this particular industry the Cashflow Statement is less helpful than usual, and here’s why:

The nature of the ORA means they collect a big lump of cash up-front, meaning the Cashflow Statement shows a big chunk of cash coming in.

However, that money isn’t income.

Most of that cash needs to be paid back when the retiree vacates the property, meaning it’s not actually revenue, it’s debt.

It’s recorded as operating cashflow (which is technically correct, but it’s completely different to operating cashflow for say, a retailer).

Look at this example from Summerset’s cashflow statement:

Summerset received $337m from residents for ORA sales, but it’s misleading to consider it “operational cashflow”.

As we already said, that money is more like a loan.

What we want to know is - what portion of that cashflow will actually turn into revenue?

As in, how much does Summerset get to keep, and how much will they have to pay back?

One way would be to say, Summerset’s deferred management fee is 25%, so we can just take 25%.

We can see receipts from new ORAs of $337m, resales of existing ORAs were $90m, which totals $427m, 25% of that is $107m.

This differs from the number in the Income Statement, which shows $75m, and here’s why:

Summerset doesn’t wait until the resident vacates before recognising income from the ORA. They start recognising it from the first day the resident moves in. Here’s how they do it:

Say they sell an ORA for $400,000 and expect to collect a $100,000 deferred management fee when their resident vacates.

First, they work out the resident’s “expected” residency (which currently is around 8 years for Summerset specifically).

Then they report this $100,000 as income bit-by-bit over the next 8 years (known as a straight-line basis in accounting jargon), which is $12,500 per year.

Therefore the $75m for deferred management fees in their Income Statement is more like a smoothed out average, versus a lump sum collected from residents who have died or vacated that particular year:

This actually makes it a pretty meaningful figure to use for profitability estimates, since it’s averaged out and shouldn’t be volatile.

So in Summerset’s case, deferred management fees for the year are $107m based on the Cashflow Statement, or $75m based on the Income Statement.

Here’s another problem with the Income Statement:

A large portion of the profit is from rises in property values.

Summerset made a profit of $544m, but $538m of that was from property valuation gains:

You might have noticed this earlier in the article when I shared this chart, but take another look:

Without those property gains, Summerset would have barely made a profit, and Ryman would have actually reported a ~$50m loss.

Another clue to how low the “real” profit these companies make is how much tax they paid in 2021 (unrealised property gains are not taxable):

Surprise - none of them paid tax.

They actually all got tax refunds/credits.

Like I said, sometimes you can bullshit the Income Statement and the Balance Sheet, but you definitely can never bullshit the IRD.

So the fact they don’t need to pay tax tells us these companies aren’t actually making any real profit.

However, these companies are definitely not losing money. They’re all growing assets at relatively fast rates, in Ryman’s case, for over two decades.

What gives?

Figuring out where the money is being made

Let’s go back to the ORA.

We’ve settled that the company only “banks” their profit when the resident dies (or moves out), and this can take some time (twenty years or longer).

This might seem like a problem, but it’s not.

Since they get all the money up-front, the profit is secure from Day 1.

Think of it like this:

You offer to sell a car to your friend for $20,000, but you also tell him that in ten years he must sell it back to you for $15,000.

He’s basically renting the car from you for $5,000.

But - he has paid $20,000 rent up front!

This is exactly how an ORA works.

So essentially these retirement villages are renting homes, but they’re collecting 400% of the rent up-front while collecting weekly fees along the way.

The big difference is, unlike cars, properties actually go up in value.

So they retain ownership of the property, which is rising in value over time, while renting it out at zero risk since they collect all the rent up front, plus they get a 300% deposit just to be safe.

From a cashflow perspective, this is incredible.

Retirement villages are basically getting millions in interest free loans from retirees that they get to sit on for 10+ years.

And what do you do with cash that’s going to sit around for 10+ years?

You invest it!

This might remind you of another famous and successful investor - Warren Buffett.

Warren Buffett’s Berkshire Hathaway is one of the biggest insurers in the world, and this is how the insurance business works:

At the start of the year you collect your premiums from millions of customers. Let’s say, $10 billion total. This is known as an insurance float.

Then during the year, you have to pay back some of that money (say, $7 billion) to your customers.

You keep the rest.

So insurers get a boatload of money up front, then slowly over time have to give some of it back.

Sound familiar?

Yes, essentially retirement villages are operating on a float.

Warren Buffett has said many times that one of the secrets to his excellent investing returns was his access to a big interest-free float. Instead of just leaving the float in the bank, he invested it in stocks, and made billions.

The good news is, compared to an insurance float, the retirement sector float is so much safer.

The first reason - there’s no uncertainty risk with the float. In insurance, you need actuaries to do complicated forecasts to ensure a surge of claims from an earthquake won’t exhaust your float and leave you bankrupt.

In the retirement sector, there is no such risk. You know exactly how much of your float you will need to pay back, and it’s guaranteed to be profitable. Summerset knows that for every $400,000 ORA they receive, they will never have to pay back more than $300,000.

The $100,000 profit is a lock from Day 1.

The second reason - it’s interest free, so there’s no risk of them defaulting.

The third reason (and even I was surprised to learn this) is the liquidity risk is also zero. They don’t have to repay the ORA until they’ve already sold the ORA to a new resident!

So technically, as soon they sell an ORA for the first time, they have a permanent float on that ORA forever.

Now unlike Warren Buffett, retirement homes in New Zealand don’t invest their float in stocks. They invest it in property - usually sections of land, and development of new villages.

This is how they manage to build and expand so fast.

Watch:

My name is Mr Ryman, and I sell you a house for $1m.

We agree I will buy it back off you in 10 years for $800k.

In the meantime, I take your $1m and buy a second house.

Now I have two $1m houses.

I sell this second house to someone else under the same terms.

Then I take that person’s $1m and buy a third house.

Now I have three $1m houses.

Technically I can just keep doing this until I have a million houses.

This is the NZ retirement home business model.

So where’s the risk?

The risk lies in the property valuations.

Let’s assume property values tumble, and I can’t sell the house again for $1m. Maybe I can only sell it for $700k.

Since I agreed to pay you back $800k, and I only sold it to the person after you for $700k, I’m now $100k out of pocket.

Say property values fall even further, and the houses become worth $600k.

Now I’ll be in even more trouble with the second house.

Of course, this risk only exists because I invested the float.

If I had just put your $1m in the bank when I received it, then I could pay you back no problem.

So the float contains risk, but it’s far less risky than an insurance float if it’s invested wisely.

Let’s figure out profitability

Let’s take a second look at the profitability of the business itself (management fees and care fees).

Normally, free cashflow is a good metric for this.

However, as we already discussed the Cashflow Statement is a bit misleading, due to the nature of how ORAs work.

The Income Statement is also redundant as it’s skewed by valuation gains.

This means we’ll have to work out some numbers ourselves to get a meaningful figure.

Here’s what makes the most sense to me:

Care fees + management fees - operating expenditure - capital expenditure = operating profit

This should be a pretty good estimate of free cashflow.

Crunch those numbers and here’s what I get:

What I see here is the day-to-day operating business (nursing and village living) isn’t actually profitable.

Ryman is $215m out of pocket after it pays its expenses. Summerset and Oceania are in the red too. Arvida is the only one that barely eeks out a profit.

This shouldn’t be a surprise now - we learned earlier these companies don’t pay tax, which means they’re not really making an operational profit.

But why aren’t they profitable?

The obvious reason to me is the care business - it’s not very good. Care rates are set by the government, so the villages have no pricing power. A few have actually complained in their annual reports that the government is allocating far too little money to care, and it’s not sustainable. Care costs a lot to provide - we have a nursing shortage in New Zealand, nurses are expensive, and it’s not a 9-5 job, its 24/7. The obvious remedy to high costs is - raise your prices. But since the rates are set by the DHBs, the villages can’t.

So if the business itself is not operationally profitable, how are these companies covering interest payments, buying land, building new villages, maintaining all their properties, paying dividends and CEO salaries?

You should already know the answer.

They’re using the float.

It’s the float that keeps this whole thing moving.

This works because the float is extremely low risk, as we already discussed.

Even though they’re not profitable on a day-to-day basis, they can deploy the float to keep buying more properties while covering the shortfall from the day-to-day losses.

But is this sustainable?

Judging by Ryman’s success over the last two decades, yes.

Take a look at the figures for Ryman over the last 6 years:

That operating loss is actually increasing.

This tells me not only is the operating business not profitable, it doesn’t scale very well either.

This makes sense because retirement villages aren’t scalable - no matter how big you get, each unit can only take one resident at a time.

Even if you have 10,000 villages, it still costs the same to house each one.

Yet the company is growing.

Let’s look at Summerset’s numbers:

This looks better - they are profitable for some years. But still definitely not scaling profitably.

Plus, their highest profit on that chart is $18m in 2019.

I’m not a Wharton graduate but I can assure you $18m profit for a $2b company is beyond terrible.

Arvida and Oceania:

Out of the four, Arvida performs the best. But they all look awful.

So is it a good business or not?

To know if this business is viable, there’s one question that I think paints the final picture:

How much has shareholder value increased over the long term?

If they’re using a float to keep reinvesting, and the business model is sound, the best gauge should be how much the company has grown their equity over the long run.

That takes a bit of rummaging through the last 20 years of annual reports, but it’s a reasonably simple calculation. I look at two things:

How much net assets (also known as shareholder’s equity) has grown per year.

How much in dividends has been paid in total.

This captures all the equity that has been grown and is still inside the company (net assets), plus all the equity that has been grown but is now outside the company (dividends).

This should give us the full amount of wealth that has been generated for shareholders over time.

Here are those numbers:

Ryman has been very impressive with 20.36% CAGR (Compounded Annual Growth Rate) over 16 years (as I said earlier, one of the best performers on NZ’s stock market, ever).

Summerset has been slightly better though; a 22.61% CAGR, though over a shorter time frame.

Arvida lags. Even though it’s a smaller company, it still doesn’t match the growth rates of Summerset and Ryman when they were also of similar size:

Arvida went from 94 cents per share to $1.84 per share over 7 years (11.74% CAGR)

Summerset went from 99 cents to $2.70 per share over 7 years (18.44% CAGR)

Ryman went from 96 cents to $2.92 over 7 years (20.37% CAGR).

Oceania has performed solidly, but still slightly lags the two bigger players.

So in terms of growth, we have two clear standouts with a consistent track record - Summerset and Ryman. Both have sustained a 20%+ annual growth for over a decade.

This also tells us that over time, the business model grows wealth and does it pretty well.

Even though the day-to-day business isn’t making money, their unique access to cheap capital is allowing them to accumulate land and property at a relatively fast rate.

Another thing to note is retirement villages are just a fancy form of housing, and villages could be easily repurposed into apartment blocks or gated communities.

The way I see it, these companies aren’t in the retirement or nursing business, they’re in the home-building business, but they’re unique in that:

They have interest-free access to a large amount of capital

They retain ownership of all the houses they build

They rent them on very unique and favourable terms

Debt and equity - things to watch out for

Other than their float, there are two ways these companies can raise capital: They can go to the bank for a loan, or they can issue more shares.

Let’s look at new share issues:

As you can see, Ryman has never needed to raise money via share issue in over twenty years, very impressive. They have funded all their expansion through profits.

Summerset also has had very little dilution with only 2% per year (and this has not been from raising capital, it’s been from issuing new shares under employee share payment schemes and the dividend reinvestment plan).

However, the other two have been diluting left and right, with share counts increasing over 13% for Oceania, and 18% for Arvida each year (!) over the last 7 years:

The issue here is something known as dilution, which happens when companies continue to issue more and more shares. They do this to raise money, but in doing so, they dilute your shareholding, meaning your shares become worth less.

This is why we use per share metrics, instead of totals, as this helps account for any dilution.

For a business that has the ability to generate millions (billions) in float, Arvida and Oceania’s dilution is a red flag.

Retirement home operators should not be diluting their shareholders at such high rates.

Here’s an excerpt from Arvida’s notes, which keep in mind is all within a single year (this level of dilution alone almost rules them out as a potential investment for me):

What makes this puzzling to me is these companies are paying dividends.

It’s like they’re telling shareholders, “Hey, we don’t have enough money, wanna buy more shares?”

While simultaneously telling them “Hey, we have too much money, here’s a dividend”.

If they just stopped paying dividends, then they wouldn’t have to raise cash, which is kind of common sense.

The only people getting rich here are the investment bankers taking care of all the paperwork.

It’s also a sign of poor management, and/or a CEO who is poor at allocating capital.

Now let’s move on to debt.

Retirement businesses are real estate businesses at their core.

One thing about real estate businesses is they go bankrupt reasonably often, and it’s always because of debt.

In the retirement sector, where they essentially survive on a float, debt becomes even more dangerous. They’re already using other people’s money, and taking on bank debt means they’ll be using even more other people’s money.

Therefore, debt is one of the biggest risk factors I see in this business.

Since the ORA debt, or float, is non-interest bearing and has very favourable repayment terms, we definitely want most of their debt to be ORA debt, versus bank debt.

Let’s check out debt levels:

Ryman is the most heavily geared with almost $7 billion in debt, a 67% gearing ratio, and also has the most portion of their debt as bank/interest-bearing debt.

Summerset is the least heavily geared.

Arvida has the best debt allocation.

Oceania kind of in between.

I find Ryman’s gearing level to be unsettling here.

68% geared is high, $7 billion in debt is high, plus they have a high portion in interest-bearing debt. If that gearing ratio manages to climb into the 70’s it’s going to be a problem.

Not surprisingly, Ryman management addressed this on their last earnings call and said they’re going to focus heavily on bringing this gearing down. That might weigh on earnings going forward.

Let’s look at interest exposure:

Nothing too concerning here across the board, at least at first glance.

Keep in mind, pretty much every company here is not profitable on a day-to-day basis, so $30m in interest can leave a dent if left to compound over time.

Arvida seems to be managing it’s debt well (likely because they’ve been raising capital via share issue), Summerset and Oceania get a pass mark, Ryman is getting close to dangerous territory.

Let’s look at valuation

Since the business is so unique, it’s hard to use traditional valuation techniques.

If you take out rises in property values, the business looks atrocious on practically all metrics (EV/EBIT, DCF etc).

That alone would be enough to pass on an investment in 90% of cases.

Personally, think the best approach is NTA (Net Tangible Assets).

Since the business is property based, valuing it based on its hard assets makes sense.

If we can buy $1 of property for 80 cents, I’d be happy.

Let’s take a look at today’s prices:

This shows we’re paying 71 cents for every $1 of Oceania’s assets, which is the cheapest out of the four. Pretty good deal.

It also shows we’re paying $1.28 for every $1 of Ryman's assets, who’s the most expensive.

Let’s look at how this compares historically:

Today’s prices are the cheapest we’ve seen in the last ten years.

You would have paid up to $2.50 per $1 of assets in the past for Summerset, and up to $4.72 per $1 of assets for Ryman.

Arvida and Oceania typically trade around book value, and are at big discounts today.

The obvious reason for this is we’ve seen a huge run up in property values in 2022, so their NTA values have spiked.

Overall, it’s clear the market believes Ryman and Summerset are worth a premium, and Arvida and Oceania are worth a discount.

Personally I think the market has it right.

We already discussed how the management team at Arvida isn’t making sense with its dilutive capital decisions, and they’re also growing significantly slower than their competitors (one probably led to the other).

So they’re about 40% cheaper, but also have been growing about 40% slower.

Ryman looks expensive to me (comparatively), considering it is laden with debt, doesn’t grow as fast as Summerset, and as we saw earlier, is burning cash and nowhere near profitability on its day-to-day operations. I think we’ll see them slow considerably as they wind down some of their debt going forward.

Another thing that rules out Ryman for me is their new CEO and chairman. Much of their growth happened under their old superstar chairman David Kerr, who resigned this year, and prior CEOs Simon Challies and Gordon McCleod.

A rockstar capital allocator is essential in this business, and the new CEO Richard Umbers doesn’t inspire confidence for me personally. He was unimpressive in his latest stint as CEO of Myer.

You could make an argument that Oceania offers value here - a big discount to NTA with a decent growth rate. However, I believe their management lets them down, as does their heavy weighting towards care beds.

That leaves Summerset. It’s well managed, 22% growth rate, conservatively geared, trading at a historically cheap valuation (22% above book), with a new numbers driven CEO who has yet to prove himself, but has a solid track record.

They’re also the least focused on care out of the four which is good, because as we’ve seen, the care business doesn’t make any money.

To me it looks like there’s only one way to make real money in this business:

Sell ORAs, max out the float and churn out new villages.

Use those new villages to sell even more ORAs to raise even more float and churn out even more new villages.

Summerset seems to be doing that the best.

But are they a good investment?

The only question that matters.

One side of Summerset’s business is the rental and nursing business, and we already saw that business isn’t very profitable.

It brings in ~$10m per year on average.

Their “real” business is generating a big float through sales of ORAs, then leveraging that float to keep accumulating properties.

Nothing wrong with that. Land is very valuable, and will keep getting more valuable.

A business based on accumulating lots of land can be good.

Let’s see how good.

Summerset has 4,930 village units.

Assume they can sell an ORA for $400k to $500k on average.

That’s around $2 billion in potential float they can generate at any one time.

They expect to double in size in the next eight years, which would be around a $4 billion float.

Impressive.

However, don’t forget the viability of this float depends entirely on their ability to resell their units at higher prices each year. If those prices start to come down, they’ll get into trouble if they’ve extended their float too far.

What makes prices go up?

Supply and demand.

Summerset predicts the 75+ demographic in NZ to triple in the next 50 years, to 17% of the population:

So demand is definitely going up.

However, supply is going up too. The market is already reasonably competitive.

What happens if (when) there are no more villages to be built?

If the market gets saturated and demand tapers, the growing property portfolio stops growing.

Then all they’re left with is a nursing and retirement village business, that doesn’t actually make any money.

Here’s why I don’t think that’s a problem:

There’s no rule saying the float needs to be used on new villages.

Residential real estate. Industrial. Apartment towers. Stocks. Acquisitions.

The float can be invested in anything.

The way I see it, the secret sauce of this business isn’t nursing homes or retirement villages, it’s the float!

$2 billion of interest-free capital, at practically zero liquidity risk.

What other business can you find that?

In a good CEO’s hands (like a Warren Buffett) this should be magic.

So to me, the keys to success in this business are a big float, and a rockstar CEO. You want someone who:

Is very adept at allocating capital

Isn’t constantly diluting shareholders to raise new capital (the float should be enough)

Isn’t constantly drawing bank debt to raise new capital (the float should be enough)

Acquires land in high-demand areas, and develops high-quality properties which will hold their value.

Keeps the day-to-day business in profit (or at least breakeven) so they’re not burning cash.

So what do we know about the Summerset Chair/CEO team of Mark Verbiest and Scott Scoullar?

Mark is a lawyer who has chaired some of NZ’s biggest companies, Scott is a career CFO who has a lot to prove. Scott is former CFO of Inland Revenue and Housing NZ which I like - he should have good contacts and a very good grasp of numbers (I love CEOs who are numbers driven, like Buffett, versus “genius” CEOs like Musk).

However, I can’t give an opinion on either because I don’t know much more about them. All I can say is the first impression doesn’t set off any alarm bells.

Scott was also on the Sharesies podcast last year. There wasn’t anything mindblowing, but his insights on the Australian market were quite valuable. If you’re interested in investing, it’s a mandatory listen and gives you a look at the type of character he is.

As for risks with this industry, there are several.

My personal opinion is the ORA arrangement is a crappy deal for residents financially. It relies on the fact that older people don’t care so much about their money anymore and just want comfort. Of course there are more than just financial reasons to move into a village, demand for village units is booming and the satisfaction rates (at least at Summerset) are very high, so people obviously see value. Still, I believe a “better” option will come along as competition grows, which means Summerset may need to pivot and amend their offering, and maybe pricing too.

Competition is inevitable. At one time it was just Ryman, then it was Ryman and Summerset, and now Oceania and Arvida have seemingly popped up out of nowhere, issued a few hundred million in shares and now Arvida is a billion dollar company. Radius and Promisia are already two small new entrants that have recently listed. More will come. It’s a business model that makes money, and not a hard business to replicate. Generally as competition increases, prices need to come down.

Property valuations and ORA prices must go up for the business model to stay viable.

A CEO who is adept at allocating capital is 1,000% necessary, and a bad CEO could easily torpedo the whole business by mismanaging the float.

As I think more about this business, it grows on me. The model offers a unique source of capital and allows the village to acquire a lot of land quickly and at low risk. But the key in this industry is to buy quality.

That means a quality CEO, because a prudent steward keeps the float safe.

Quality properties, because robust property values keep the float safe.

Most importantly, quality service because keeping residents happy and keeping the brand strong keeps the float safe.

Remember, the float is the only thing that keeps this whole ship moving.

Keep the float safe.

My opinion is Summerset is the standout in the sector:

The highest growth rate in the sector

The lowest debt ratio in the sector

Largest land bank in the sector

Lowest care exposure in the sector

Exclusively greenfield development (usually = higher quality and consistency)

High satisfaction rates

High build rate

Their float looks safe.

Based on the forward growth profile, and the favourable access to capital, for exposure to property I prefer Summerset to a regular REIT. I think the risk/reward is favourable near or below NTA.

Disclaimer: The numbers and information in this piece are not audited and may be inaccurate. Always do your own research. Investing contains risk and you can lose money. Before you invest your money, you should seek financial advice. This article is not financial advice and I am not your financial advisor. This article is for entertainment purposes only. You are advised to read it under the assumption that I am not very smart and am probably wrong all of the time. Disclosure: Long OCA, SUM

References:

Which Retirement Option Costs The Most?